What are some business card mistakes to avoid, and how can customers avoid overspending and debt?

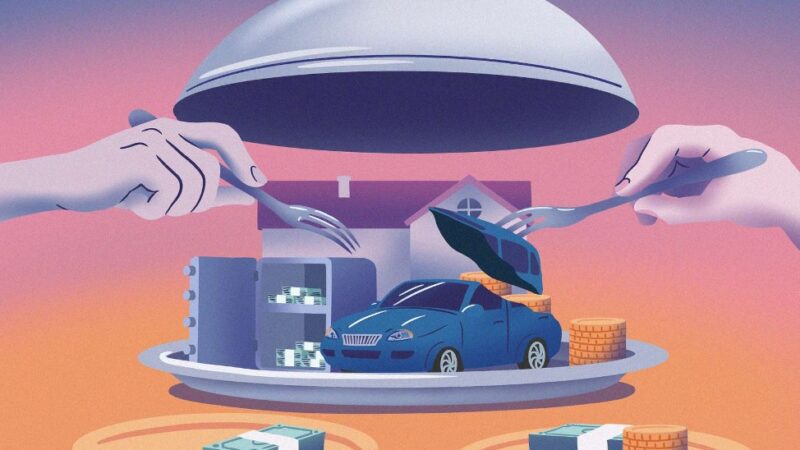

Business cards offer comfort and adaptability for overseeing funds, however like any monetary tool, they accompany potential pitfalls that users should explore carefully. From overspending to debt accumulation, understanding these risks and executing techniques to mitigate them is essential for mindful card use. Some common pitfalls associated with myprepaidcenter cards and how users can avoid them to keep up with monetary soundness.

- Overspending:

One of the main risks associated with Business cards is overspending. Without similar requirements as conventional charge cards connected to a ledger, users might be enticed to spend too far in the red, prompting monetary strain and debt accumulation.

- Relief Methodology: Set a financial plan and stick to it. Decide how much you can afford to stack onto your Business card every month and apportion assets for fundamental costs like food, bills, and transportation. Avoid motivation buys and consistently audit your spending to guarantee you’re remaining within financial plan.

- Expenses and Charges:

Business cards might accompany different charges, including initiation expenses, month to month upkeep charges, ATM withdrawal expenses, and more. These expenses can rapidly add up and eat into your accessible assets if you don’t watch out.

- Moderation Methodology: Find out about the charge plan associated with your Business card and select cards with transparent expense designs and lower expenses where conceivable. Be aware of how you utilize your card to avoid pointless charges, for example, ATM withdrawals from out-of-network machines.

- Absence of FDIC Protection:

Not at all like customary ledgers, Business cards don’t offer FDIC protection, which safeguards shoppers’ subsidizes in case of bank disappointment. This absence of protection implies that assets stacked onto Business cards may not be as secure in that frame of mind of unforeseen conditions.

- Alleviation Methodology: Cutoff how much cash you load onto your Business card to what you really want for sure fire costs. Consider keeping bigger amounts of cash in a customary ledger with FDIC protection for added security.

- Hazard of Extortion and Unauthorized Exchanges:

Likewise with any monetary instrument, Business cards are helpless against misrepresentation and unauthorized exchanges. In the event that your card information is compromised, you might actually lose reserves or become a survivor of wholesale fraud.

- Alleviation Methodology: Safeguard your card information by keeping it secure and just imparting it to confided in substances. Routinely monitor your card action for any unauthorized exchanges and report any dubious action to Business right away. Consider choosing cards with worked in security highlights, for example, EMV chip innovation and misrepresentation monitoring administrations.

Business my prepaid center offer comfort and adaptability, users should know about the likely pitfalls and find proactive ways to mitigate risks. By setting a spending plan, limiting expenses, restricting openness to misfortune, and defending against extortion, users can partake in the advantages of Business cards while keeping up with monetary soundness and security.