Important Characteristics to Seek in a MetaTrader EA

Strong tools that can automate trading and enable traders to reach greater results are MetaTrader Expert Advisors (EAs). Maximizing your trading performance depends on your selecting the correct EA. The main characteristics to search for in a metatrader ea to guarantee it satisfies your needs and improves your trading experience will be covered on this page.

Accessible User Interface

Simple Guide

A decent EA should have an understandable interface that facilitates operation and navigation. Seek EAs with simple controls and clean menus. Beginning users especially need to know how to set up and personalize their EA without ambiguity.

Before You Trade: Backtesting Capabilities

One key tool that lets you evaluate your EA with past data is backtesting. This clarifies how your approaches would have worked in the past and guides required changes. Before using your techniques in actual trading, an EA with strong backtesting features can assist you in improving them.

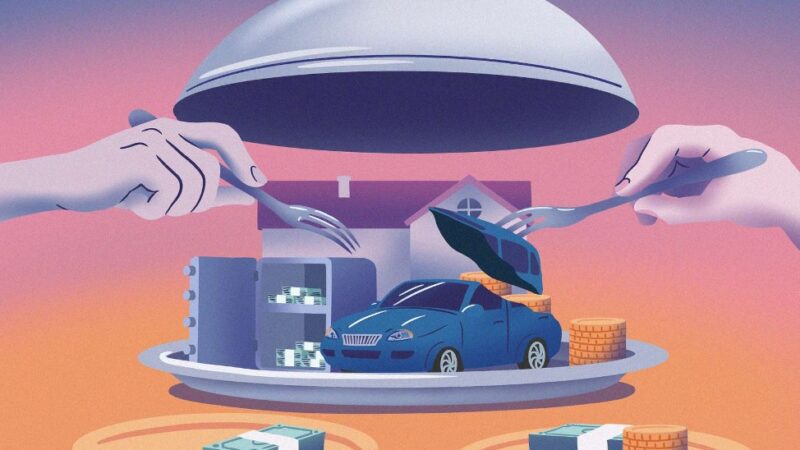

Methods of Risk Management Tools

Safeguard Your Assets

Good trading depends on efficient risk control. Search for EAs featuring built-in stop-loss and take-profit settings for risk management. These instruments protect your money and keep a good trading account, therefore helping you to control any losses and guarantee earnings.

Data Analysis in Real Time

Remain Current

Real-time data analysis should be included in an efficient EA. This guarantees that the most recent market data becomes the foundation of your trading judgments. Real-time data lets the EA make quick trades, therefore enabling you to profit from changes in the market as they occur.

Frequent Changes and Assistance

Stay Up to Date with Changes

Your EA should change with the always-shifting currency market. Select an EA that gets updated often to keep current with changes in the market and technology. Furthermore very important is consistent client support. Make sure you have aid available to you anytime you run across problems or require assistance with your EA.

Monitoring and Correcting Performance Tracking

You should routinely monitor the performance of your EA. Search for an EA with performance tracking tools including analytics and thorough reports. This lets you see how the EA is doing and make the required changes to raise its efficiency.

Choosing the appropriate meta trader ea calls for weighing various important factors. Look for a user-friendly interface, customizing choices, strong backtesting tools, good risk management tools, real-time data analysis, frequent updates and support, and performance tracking. The correct EA will help you maximize your trading and enjoy a more successful and quick trading environment.